|

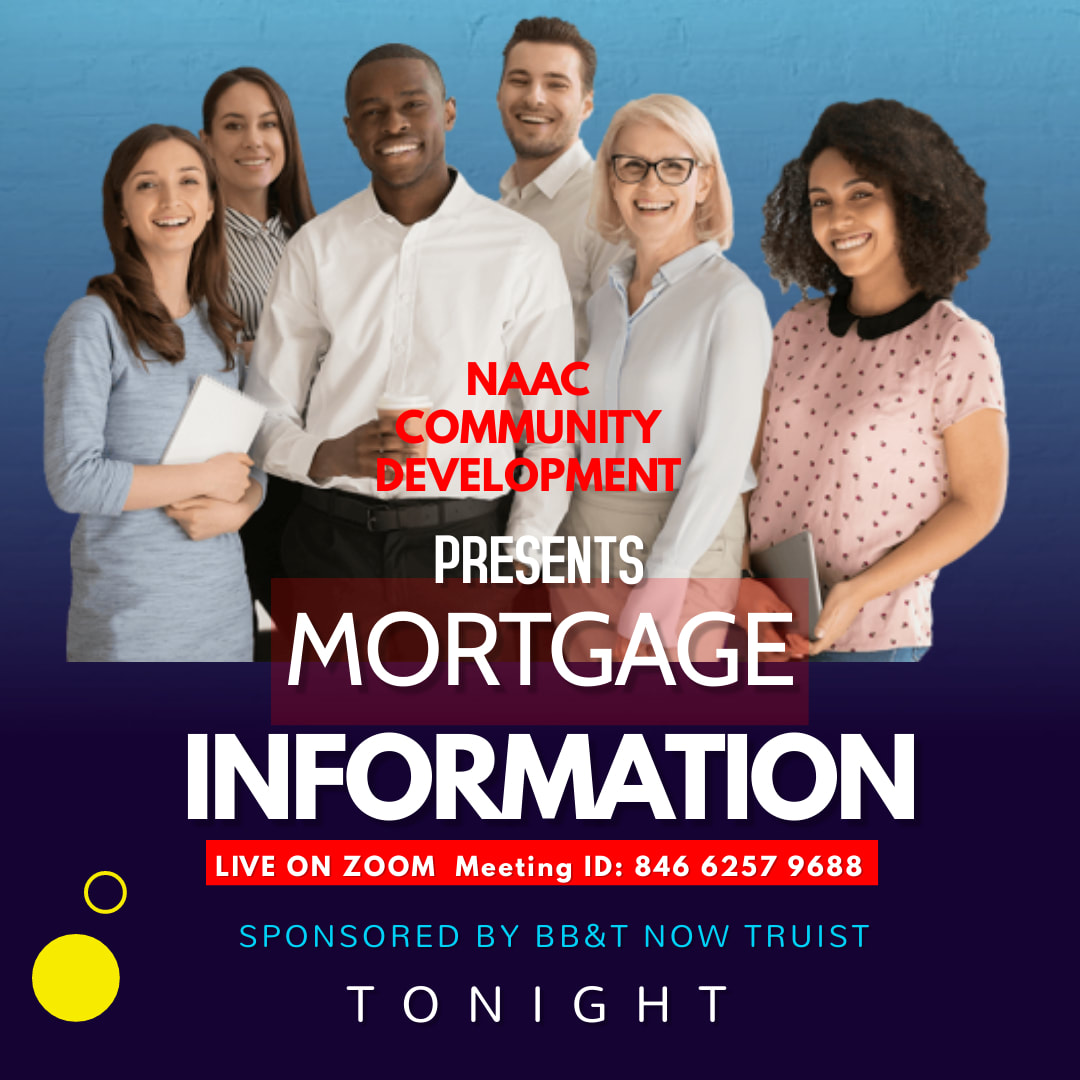

CLICK THE FOLLOWING LINK: 5-6 PM If you are currently living with your parents or other families, in an apartment, or renting a house, you may be thinking about buying a home of your own. This arrangement can be an exciting time. Looking at properties, deciding whether to buy a home or build a new one and finding financing will take up a lot of your time.

If you are a first-time homebuyer, you will be nervous about finding the right home, investing money on a down payment, and being approved for financing. Once you have found a home, it will usually take between two or three months before you can move in. Financing your first home can be the most frustrating part of the home buying process. This process is the time when you will figure out how to pay for the home. Most people have to take out a mortgage loan to afford the price. Which mortgage loans are suitable for you? How much of a down payment will be necessary? What is escrow? You will have many questions about financing your first home. By knowing the facts, paying attention to interest rates, and looking into all of your mortgage options, you will be able to choose repayment terms that will fit your current income and allow you to make those monthly payments safely. We can help you! |

Author:

|

RSS Feed

RSS Feed