clICK HERE TO REGISTEREACH WEEK ON THURSDAY AT 5 PM

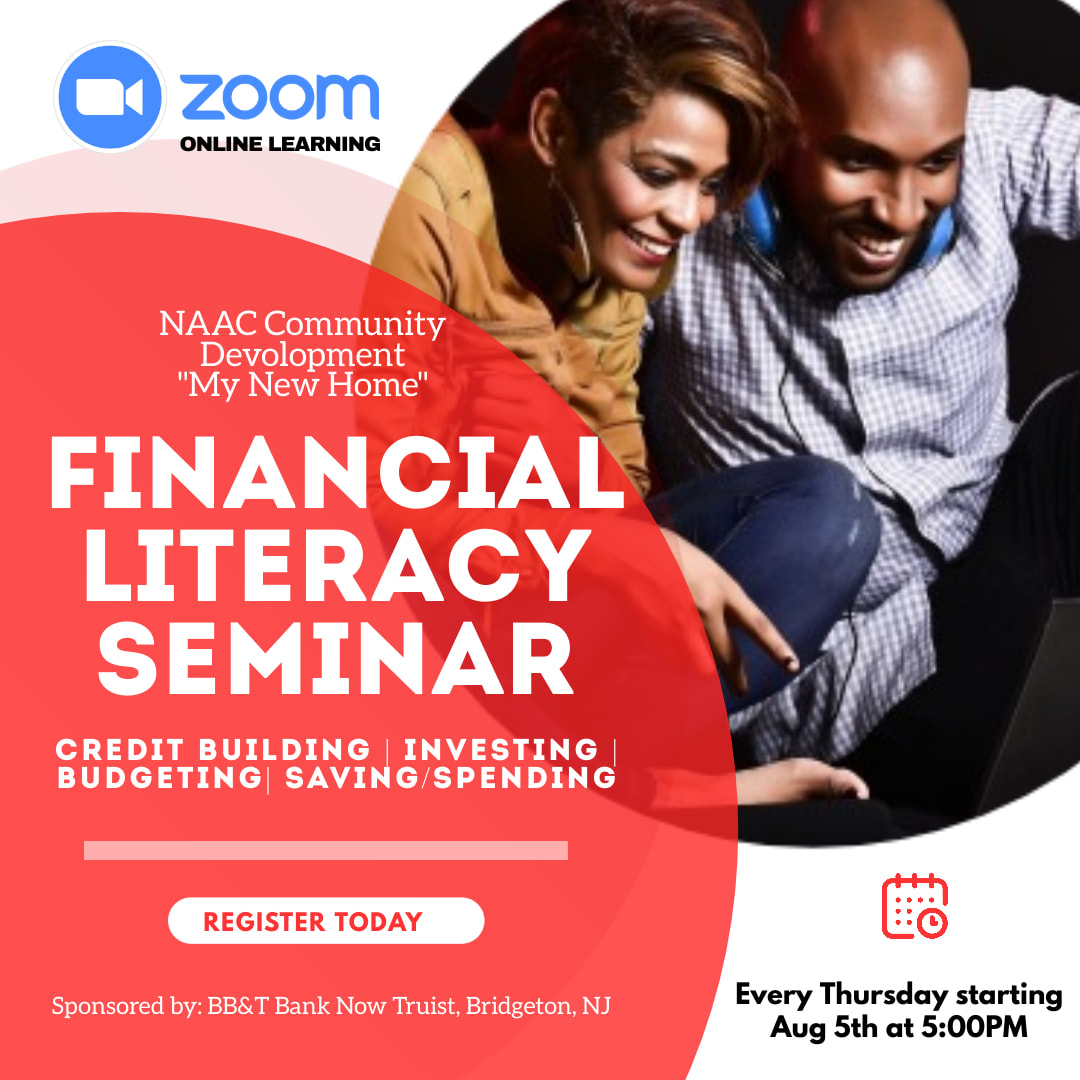

Starting Thursday, August 5th at 5:00 pm Learn from visionary entrepreneurs in the financial industry who are passionate about financial literacy that focuses on the advancement of families. Wikipedia defines 'financial literacy as "possession of the set of skills /knowledge that allows an individual to make informed and effective decisions with all of their financial resources." Sponsored by: BB&T Bank Now Truist, Bridgeton, NJ With this series, we will offer financial literacy topics that all relate to each other under the umbrella of personal finance. • College planning (scholarships, student loans, student budgeting, why) • Saving money (emergency savings, major purchases, retirement plans) • Budgeting and spending (methods, best practices, where, habits) • Credit health (improving and understanding your credit score) • Debt management (refinancing, being debt-free, understanding credit) • Investing (stock market, investment products, asset allocation) • Risk management (life insurance and identity theft) • Family Insurance (life, term, home, car) Learn the reason why you should be financially literate. According to FINRA, only 46 percent of Americans have a "rainy day fund." At the same time, two-thirds of the total population of Americans do not have at least $1,000 in an emergency fund or bank account (Associated Press-NORC Center for Public Affairs Research). Nearly 26.9 percent of families in the United States do not have a bank or are underbanked, and they have no access to savings, lending, and other essential financial services (FDIC). According to FINRA, almost one-third of Americans pay only the minimum amount on their credit card each month, and nearly 35 percent of adults with a credit file have some reports of debt in collections (Urban Institute). From experience, we found that there is an urgent need for financial literacy and self-sufficiency. Up to two-thirds of the families are uneducated. There are limited resources to bridge this gap. We have also found a large percentage of families that wish to be homeowners. Many communities are victims of foreclosures, vacant homes, crime, and loss of industry. This dilemma can be turned around by merely educating individuals on the path to self-sufficiency and homeownership and aiding homeowners to maintain their existing homes. Homeownership brings tremendous social benefits for families, communities, and the country as a whole. Homeownership remains to be a crucial part of the American Dream. With continued low interest rates and programs, consumers and policymakers are again considering the economics of buying versus renting. The benefits are outstanding for communities and individuals, but only under the right circumstances and proper education. Purchasing affordable homes is fundamental to community development. The importance of helping more families satisfy these objectives cannot be overstated. Decent, affordable, and accessible homes foster self-sufficiency, bring stability to families and vitality to distressed communities, and support overall economic growth. Homeownership improves children's life outcomes and reduces a list of social and economic problems that place financial strains on the nation's education, public health, social service, law enforcement, criminal justice, and welfare systems. Hopefully, the "My New Home NJ" project will be the beginning of the entire community renewal. This project's long-term benefits can include creating more jobs, improving community relations, community empowerment, heightened economic status, environmental restoration, and enhancement of the quality of life in our neighborhood. Comments are closed.

|

Author:

|

RSS Feed

RSS Feed